By Lori Berkey, Contributing Writer

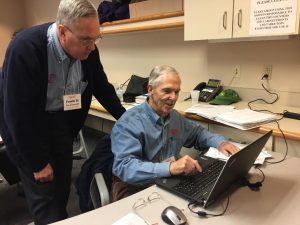

Hudson – Twelve years ago, after Frank Dutt retired from his engineering job, he became bored and was looking for something to do. He saw an AARP ad that was seeking people to become volunteer tax preparers, and he decided to sign up. Still at it, the Hudson resident has helped each tax season since, and has assisted about 2,000 people with their filings.

“It’s very rewarding,” Dutt said, adding that many of the people who come for assistance have lost a spouse or are struggling financially, and finding ways to get them a few hundred dollars – or more – back is a big help.

“There was an older woman who was a widow who literally got tears in her eyes when she found out she was going to get a couple hundred dollars back,” he said. “You can’t beat that.”

Dutt started his volunteerism when living in New York, went through the AARP tax training program there and helped out until he moved to Hudson three years ago. Massachusetts tax law is different and he had learn the specifics to start helping in his new state. He passed the test, and after his first year volunteering in Massachusetts, the person who was coordinating his site left, so Dutt began helping out with coordination details.

This year, Dutt is not only a volunteer tax preparer himself, but he coordinates the volunteer tax program at six sites including the senior centers in Shrewsbury,

Northborough, Marlborough and Hudson and the public libraries in Shrewsbury and Marlborough. He supports 15 other volunteer preparers, checks for accuracy and communicates with the site contacts to arrange the sign-up process.

The trained volunteers are equipped to process simple to moderate filings. Dutt said they are not allowed to process filings related to rental properties or day trader filings where people have a multitude of stock issues. The volunteers do help prepare filings for a range of situations from those receiving social security plus other forms of retirement incomes, IRA distributions and home ownership; those needing itemized deductions, small business taxes for those who have no employees and no earnings from sales.

According to Dutt, many people who come in are unaware of the Circuit Breaker tax break and other deduction options, and he likes being able to help people take advantage of the opportunity for refunds.

The AARP volunteer tax program runs from Feb. 1-April 14 each year, generally offering services one day per week per site for about five hours. He said the slots generally fill up each year and the only thing that limits the amount of appointments is the number of volunteers. More volunteers are always needed, Dutt noted.

Per Dutt, many of the people who volunteer as tax preparers come from multiple disciplines, such as retired scientists, teachers, nurses and more. Volunteer prospects must go through a training which lasts 20-25 hours and pass a certification test as well as a CORI background test.

“It’s a rewarding way to volunteer. I encourage it,” Dutt said, adding that he also encourages people who are of low to moderate income to take advantage of the free service.

“It’s a good program,” he said.

To find a volunteer tax preparing site in your location or to apply to become an AARP tax volunteer, visit www.AARP.org.