[email protected]

508-733-6005

We are in a joyous time of year. And it seems many people are just down in the dumps. The economy seems to be weighing on many. When it comes to houses, there is a sense sellers aren’t selling and buyers are not buying. The real estate market isn’t crashing…and it is adjusting to a more normal market…call it cooling. Let’s take a closer look at this, dispel some false rumors and feel better as we move deeper into the holiday season.

“Sellers aren’t selling”

If someone puts their home on the market in the depths of winter, they are motivated to sell. It’s a great time to buy. While some 6 months ago may have listed their home at a crazy high price, “to test the market”, we are seeing more realism in pricing. No “Filenes Bargain Basement” pricing…just more realism.

People still need to sell. People still get divorced or need larger homes. Parents/spouses pass away.

The biggest stumbling block is often getting the home ready for showings. We’ve placed homes on the market in a matter of days when needed. It can be done!

“Buyers are not buying”

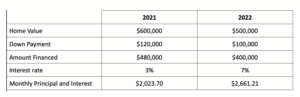

Affordability is a big issue for buyers. Interest rates have gone up….and are softening. Not back to 2%, softening. (Like me) Mortgage loan originators don’t make money unless they sell mortgages. The mortgage industry is responding with new products and some dusted off products.

“Buy Down” programs are being talked up. A 2-1 or 3-2-1 program has the seller funding some interest payments for 2 or 3 years reducing the buyers monthly payment.

Adjustable rate mortgages have been around for years…and have been modified to minimize some of the shortcomings of the products from the 1980s.

Of course, a buyer can always refinance if mortgage rates go down. I don’t like betting where mortgage rates are going….and I look at it as an opportunistic play.

Lamacchia Realty (where I’m affiliated) is looking into assumable mortgages. One of the things attractive about the last couple years was the low mortgage interest rates. Did you know FHA/USDA/VA loans are assumable? So you could buy a house and take over the lower interest rate payment? Anthony Lamacchia believes there is an opportunity to help buyers and sellers using the assumability of the mortgage…and even setting up a business to process the paperwork? That’s innovation.

Hopefully this article dispelled some of the false myths and endless negative chatter. We have a lot to be grateful for and to feel good about about as as a community. Happy New Year to you and yours.

Here is free app for your phone/tablet tied directly to the MLS https://www.homesnap.com/Gary-Kelley

Gary is heard on WCRN AM 830 and/or seen on WMCT-TV discussing “All Things Real Estate.”

If you need advice on selling your home or buying a new one, give us a call 508-733-6005.